Why do many of us fail to achieve our financial goals, despite careful planning? With 35% of adults seeing their finances decline and a median credit card interest rate of 24.62%, the challenges are immense. Mistakes in financial goal setting frequently hinder progress. The U.S. household savings rate of just 3.6% underscores the importance of smart planning. This article uncovers the five most common financial goal setting errors and how to sidestep them.

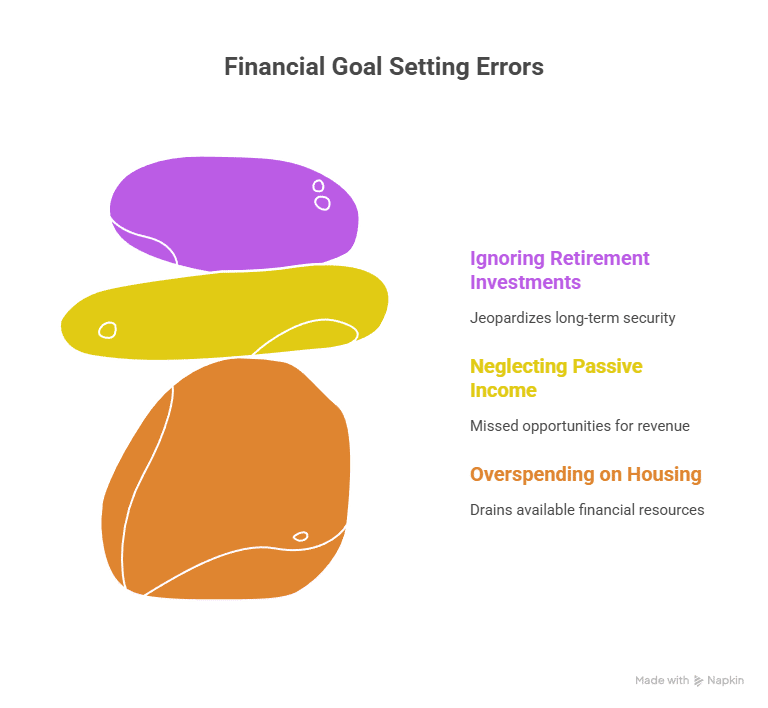

Financial goal setting errors can derail even the most well-intentioned plans. From overspending on housing, a major risk highlighted by the 28/36 budget rule, to overlooking passive income, small mistakes can accumulate. Over 1 in 3 Americans neglect retirement investments, jeopardizing their long-term financial security. However, with the right strategies, these pitfalls can be transformed into opportunities for growth.

Key Takeaways

- 35% of adults face worsening finances, stressing the urgency of smart planning.

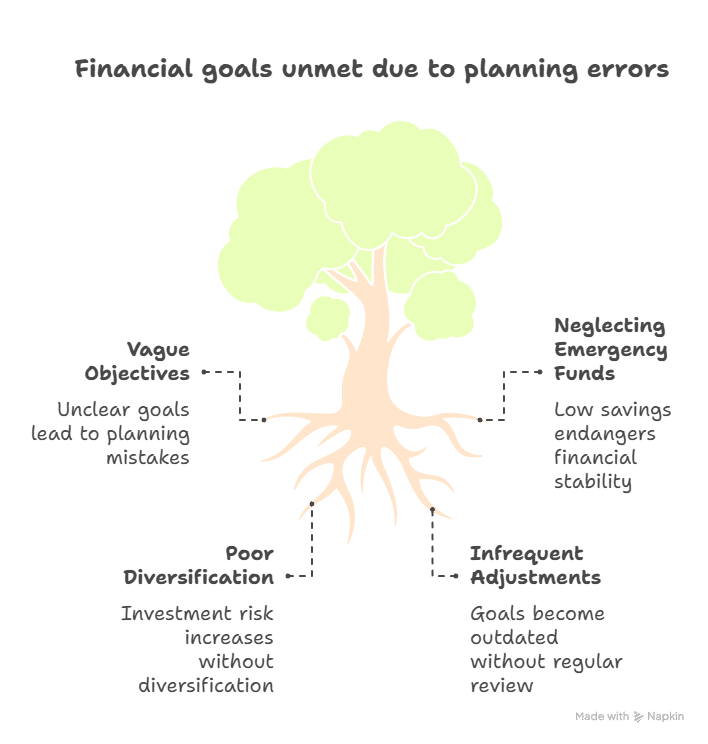

- Mistakes in financial goal setting often stem from vague objectives or ignoring measurable steps.

- SMART goals reduce errors by focusing on Specific, Measurable, Achievable, Relevant, and Time-bound targets.

- Common errors include neglecting emergency funds (3.6% savings rate) and poor investment diversification.

- Adjusting goals regularly prevents oversights like overreacting to market swings or failing to review progress.

Why do many of us fail to achieve our financial goals, despite careful planning? With 35% of adults seeing their finances decline and a median credit card interest rate of 24.62%, the challenges are immense. Mistakes in financial goal setting frequently hinder progress. The U.S. household savings rate of just 3.6% underscores the importance of smart planning. This article uncovers the five most common financial goal setting errors and how to sidestep them.

You can read the full article on trending side hustles for 2025 here: https://pennypowerplay.com/trending-side-hustles-2025/.

Financial goal setting errors can derail even the most well-intentioned plans. From overspending on housing, a major risk highlighted by the 28/36 budget rule, to overlooking passive income, small mistakes can accumulate. Over 1 in 3 Americans neglect retirement investments, jeopardizing their long-term financial security. However, with the right strategies, these pitfalls can be transformed into opportunities for growth.

Understanding SMART Financial Goals

Setting SMART financial goals is like creating a roadmap for success. The acronym SMART stands for Specific, Measurable, Achievable, Relevant, and Time-bound. Each component is crucial in preventing common financial goal setting mistakes such as vagueness or unrealistic timelines.

What Does SMART Stand For?

- Specific: “Save for retirement” becomes “Save $500 monthly in a 401(k).”

- Measurable: Track progress with apps like Mint or YNAB to avoid avoiding pitfalls in setting financial goals.

- Achievable: Align goals with income. For example, a $28,000 wedding budget vs. $100,000 fantasy.

- Relevant: Prioritize goals like emergency funds over less urgent desires.

- Time-bound: Set deadlines like “Pay off $20K credit card debt in 24 months.”

Why SMART Goals Matter for Your Finances

Research indicates that SMART goals can significantly reduce financial stress. Over 44 states offer ABLE programs to help save tax-free for disabilities, but only if goals align with account limits ($235K–$550K). This structure helps avoid overspending. For instance:

| Non-SMART | “Save money” |

|---|---|

| SMART | “Automate $100 weekly to a high-yield savings account” |

Using SMART goals prevents oversights like ignoring state-specific ABLE plan limits. By combining clarity and realism, you create goals that stick. Start today—your future self will thank you.

Mistake 1: Setting Vague Objectives

“One of the most common mistakes in financial goal setting is not tracking measurable progress.”

Financial goal setting blunders often begin with vague objectives. Phrases like “save more money” or “reduce debt” are common but lack direction. These key mistakes in financial goal planning hinder progress because your brain finds it hard to act on ambiguity. Consider this: “I want to save money” seems achievable until you realize you have no plan to track it.

“Vague goals are like empty roadmaps—you can’t follow them.”

Research indicates that teams with clear goals see a 20-25% boost in performance (Leiden University). Why? Specificity brings clarity. Let’s compare:

- Vague: “Increase savings.”

- Specific: “Save $200 monthly into a high-yield savings account.”

The second example is clear about the amount, method, and action required. Vague goals fail because they sidestep accountability and measurable steps.

Psychologically, vagueness often stems from fear of failure. To overcome this, follow three steps:

- Replace “save more” with a dollar amount and timeline.

- Link goals to tools like budgeting apps or retirement calculators.

- Break large goals into weekly or monthly mini-targets.

A goal like “pay off $10k in credit card debt by 2025” becomes actionable with $200 monthly payments. Clarity turns blunders into progress.

“Avoid these mistakes in financial goal setting to improve your money habits in 2025.”

How to Create Specific, Clear Financial Objectives

Avoid missteps in financial goal setting by turning vague ideas into clear targets. Begin with these five questions to define your path:

- What exact amount or outcome do I want to achieve?

- Why does this goal matter to my life or future?

- Who will be involved in reaching this goal?

- Where will this goal impact my finances?

- Which resources (income, tools, or support) will I use?

“Research shows that avoiding mistakes in financial goal setting leads to better long-term savings.”

For example, “save for retirement” becomes “Contribute $6,000 to my Roth IRA by December 2025”. Use the 50/30/20 budget framework. Allocate 50% for needs, 30% for wants, and 20% for savings/debt.

“Specificity turns uncertainty into action.” – Financial Advisor, National Endowment for Financial Education

Write down your answers on a worksheet. A vague goal like “reduce debt” becomes actionable. For instance, “Pay off $5,000 in credit card debt by June 2024 using a debt snowball strategy.”

Flexibility is key. Review your plan every quarter to adjust amounts or timelines as life changes. Clear objectives help avoid common missteps in financial goal setting and keep you on track.

“To learn how one teen built a business with smart money habits, read our post on turning pocket money into a small business.”

Mistake 2: Ignoring the Measurable Aspect

One of the most costly financial goal setting misjudgments is failing to define measurable outcomes. Without concrete numbers or benchmarks, progress remains invisible, turning goals into abstract hopes. Imagine aiming to “increase savings” without a target amount—how will you know when you’ve succeeded?

“Without measurable goals, we couldn’t track progress. Duplicated work and wasted time followed.” — RIA Financial Team Review

Consider the RIA’s experience: without clear metrics, their team duplicated efforts by exporting data from QuickBooks and NetSuite into spreadsheets. Similarly, an ERP project collapsed because outcomes weren’t quantified, leading to a $2.1M overhaul. Numbers transform vague ideas into actionable steps.

Effective goals use specific metrics like these:

- Fixed dollar targets (e.g., “Save $1,000 monthly”)

- Percentage goals (e.g., “Boost investment returns by 5% annually”)

- Time-bound counts (e.g., “Pay off $20K credit card debt in 18 months”)

Tools like Mint or Excel simplify tracking. By setting measurable benchmarks, you create clarity. An 8% portfolio return isn’t just a wish—it’s a target you can monitor weekly. Without this, you risk repeating the RIA’s misjudgments, where ambiguity led to wasted resources.

Effective Methods to Track Financial Progress

Tracking your financial progress helps avoid mistakes in financial goal setting by making vague targets concrete. Choose tools that align with your financial objectives. For instance, budgeting apps for daily expenses, spreadsheets for long-term savings, or calendar reminders for debt repayment deadlines.

- Daily checks: Apps like Mint or Credit Karma categorize spending in real time.

- Weekly reviews: Adjust budgets using YNAB’s “zero-based budgeting” feature to avoid overspending.

- Monthly summaries: Compare actual vs. planned savings using Excel templates to spot trends.

| Tool | Best For | Key Features |

|---|---|---|

| Credit Karma | Credit score monitoring | Free debt tracking, personalized credit tips |

| YNAB | Budgeting | Goal-based tracking, habit-building alerts |

| Excel | Customized goals | Flexible formulas, visual charts |

A

33% higher success rate

is linked to written goals, as Gail Matthews’ study found. Combine tools with habits: schedule weekly reviews like a doctor’s appointment. Adjust goals when metrics show setbacks—like overspending categories—before they become irreversiblemistakes in financial goal setting.

Mistake 3: Unrealistic Expectations

One of the common financial goal setting mistakes is expecting overnight success. Dreams of sudden wealth or instant savings breakthroughs ignore the reality of gradual progress. For instance, aiming for a 1,000% revenue jump in a single year overlooks market unpredictability and operational limits. Your brain treats such goals like unreachable targets, leading to frustration when results lag.

“Unrealistic goals create a cycle of hope and despair.” — Harvard Business Review

Why does this happen? Social media highlights others’ successes while hiding their efforts. You might think, “If they did it, so can I!”—but ignoring your unique circumstances sets you up for failure. Consider these red flags:

- Planning to save 75% of income without adjusting fixed costs

- Expecting 100% investment returns in one year

- Ignoring economic trends or personal cash flow limits

| Unrealistic | Realistic |

|---|---|

| Save $50,000 in 3 months | Save 15% of income monthly |

| Quit your job for trading within a month | Start with a $500/month side hustle |

Research shows 80% of new investors abandon plans when gains don’t materialize instantly. Instead, build goals around your current income, expenses, and market realities. Adjust expectations using historical performance and expert benchmarks. Small, consistent steps outperform wishful thinking every time.

“A recent social media trend called ‘The Great Lock In’ encourages individuals to adopt disciplined financial habits, such as daily budgeting and saving, to achieve their financial goals by the end of the year (Investopedia).”

Setting Challenging Yet Achievable Financial Targets

Starting with avoiding pitfalls in setting financial goals is key to setting goals that challenge yet don’t overwhelm. A tiered approach helps organize your goals into three levels: baseline (achievable), target (challenging), and stretch (ambitious). This ensures steady progress while keeping motivation high.

| Goal Tier | Description | Example |

|---|---|---|

| Baseline | Short-term, realistic targets | Building a $1,000 emergency fund in 3 months |

| Target | Mid-range goals requiring effort | Pay off $5,000 credit card debt in 18 months |

| Stretch | Long-term aspirations with potential | Save $200,000 for a down payment by 2030 |

Begin by evaluating your current income, expenses, and past achievements. Utilize tools like Mint or YNAB to monitor spending and automate savings. Military families who sought advice saw their savings increase by 2.5 times, highlighting the value of professional guidance.

- Baseline goals: Emergency funds, budget adjustments

- Target goals: Debt reduction, small investments

- Stretch goals: Retirement plans, major purchases

Online bookkeeping tools can minimize errors and simplify tracking. Combine this with SMART criteria—specific, measurable, achievable, relevant, time-bound—to prevent frustration. Regularly update your goals based on real data to stay on course.

Mistake 4: Neglecting Time Constraints

Ignoring deadlines is a key mistake in financial goal planning. Without a timeline, goals like “pay off debt” remain vague dreams. For instance, saying “I’ll save for retirement someday” lacks urgency. Experts agree: time-bound targets boost success. Imagine aiming to build an emergency fund in 12 months or save for a down payment in five years. Specific dates keep you focused.

Timeframes matter because money grows over time. Delaying investments can cost thousands due to missed compound interest. For example, saving $200/month in a 401(k) starting at 30 versus 40 reduces retirement funds by 30% or more. Here’s how to set realistic timelines:

- Short-term (1 year): Emergency fund, debt payoff

- Medium-term (3–5 years): Home down payment, education costs

- Long-term (10+ years): Retirement, major wealth goals

A balanced approach avoids extremes. Deadlines too far off let procrastination creep in, while unrealistic short deadlines lead to burnout. Use milestones to track progress. For instance, if your goal is to save $20,000 for a car in four years, break it into $4,000 yearly targets. Review these checkpoints quarterly to stay on track.

| Goal Type | Recommended Timeline |

|---|---|

| Emergency Fund | 12 months |

| Retirement Savings | Decades |

| Student Loan Payoff | 3–5 years |

Remember: Time is money. Build deadlines into your plans. Financial advisors recommend reviewing timelines annually to adapt to life changes like job shifts or family needs. Don’t let procrastination turn “someday” into never.

Creating Effective Timelines for Financial Goals

Effective timelines transform vague dreams into concrete actions. To sidestep common financial goal setting pitfalls, it’s crucial to set clear deadlines. We’ll explore how to craft timeframes that resonate with your personal priorities.

“If you have a business plan, you can actually utilize it to set milestones and create a roadmap for your business.”

Start by planning backward: begin with your ultimate goal, then break it down into manageable phases. For example, saving $100 each month for retirement can significantly grow through compound interest. Here’s how to organize your timeline:

- Identify your short-term goals (next 3 years): This could include paying off credit cards or saving for a trip.

- Set medium-term goals (3–7 years): Such as saving for a down payment on a house or funding graduate studies.

- Outline long-term goals (7+ years): Like retirement savings or achieving debt-free status.

Strategically allocate resources. For instance, after paying off debt, aim to save 15% of your income for retirement. Use calendars to align deadlines with tax periods or paydays. Regularly review your progress, adjusting timelines as needed due to life changes or emergencies. Flexibility is key to avoiding frustration and staying on course.

Common financial goal setting errors often stem from inflexible timelines. By dividing goals into 90-day, monthly, and weekly tasks, you foster habits that grow over time. Utilize tools like Mint or Excel to track your progress. Remember, realistic deadlines combined with regular assessments lead to enduring success.

Mistake 5: Failing to Review and Adjust Goals

One of the most critical missteps in financial goal setting is neglecting regular reviews. Without adjusting plans as life changes, even well-intentioned goals can become outdated. Financial markets shift, income fluctuates, and personal priorities evolve—all reasons to revisit your strategy at least quarterly.

Ignoring reviews often stems from fear of failure or complacency. Yet data shows consequences: the median credit card rate hit 24.62% in June 2024, making rigid debt plans costly. Meanwhile, the U.S. savings rate of 3.6% in April 2024 highlights a need for proactive adjustments.

| Frequency | Action |

|---|---|

| Monthly | Check budget vs. spending |

| Quarterly | Adjust investments or debt payoff timelines |

| Annually | Reassess long-term goals like retirement |

“SMART goals become SMARTER when reviewed and refined,” says financial advisor Laura Smith. “Flexibility ensures goals stay aligned with your life.”

Adaptability matters. For instance, the 28/36 rule (housing ≤28% income, total debt ≤36%) needs regular checks. Similarly, the 10% penalty for early retirement withdrawals means reviewing retirement plans avoids costly mistakes.

Regular reviews turn setbacks into learning opportunities. By integrating adjustments into your routine, you avoid the missteps in financial goal setting that derail progress. Embrace flexibility to stay on track.

Implementing Regular Financial Goal Reviews

Regular reviews help avoid financial goal setting misjudgments by ensuring your plans stay current with your progress. Here’s a simple framework to keep you on track:

| Goal Type | Review Frequency |

|---|---|

| Spending Targets | Weekly |

| Savings Goals | Monthly |

| Investments | Quarterly |

| Retirement Planning | Annually |

Here’s what to do during each review:

- Compare actual vs. target numbers (e.g., savings vs. monthly goals)

- Identify roadblocks like unexpected expenses or bad habits

- Adjust strategies, not just goals, when gaps appear

- Update action plans using data, not guesswork

“The ‘R’ in SMARTER stands for Reviewed—a step many skip but experts recommend.” – Financial Planning Standards Council

- What worked and what didn’t

- New opportunities or risks

- Revised timelines or budgets

Having a financial advisor or accountability partner during reviews adds objectivity. Track changes over time to spot patterns. Remember, small adjustments now avoid major setbacks later.

The Role of Accountability in Goal Setting

Reaching your 2025 financial goals requires more than just a plan—it demands accountability. By sharing your goals with others, you transform vague dreams into concrete actions. This approach significantly reduces financial goal setting errors. Studies indicate that making public commitments can increase success rates by 65%, making it harder to falter.

“Telling someone your goals doubles your chances of success.”

- Join peer groups focused on SMART financial goals (Specific, Measurable, Achievable, Relevant, Time-bound)

- Partner with mentors who’ve navigated similar financial journeys

- Use apps like Mint or YNAB to track progress publicly

Sharing your goals brings two key advantages:

- Clarity: Explaining your objectives to others helps you refine vague ideas into clear plans

- Support: Networks offer encouragement during setbacks and celebrate successes, reducing mistakes in financial goal setting caused by isolation

However, be cautious. Steer clear of groups that push for unrealistic timelines or judge your progress harshly. Find a balance between openness and privacy—share strategies openly but keep sensitive details confidential. Regularly review your progress every 90 days, as suggested earlier, to stay on course. Remember, even large corporations like Fortune 500 companies use this method. They conduct team audits and performance reviews to prevent costly errors.

Resources for Effective Financial Goal Setting

Choosing the right tools can transform avoiding pitfalls in setting financial goals into a reality. Start with apps like Mint or YNAB, which track spending and align with SMART frameworks. For investors, Grip Invest offers tools to explore low-risk options like index funds or government bonds. These platforms simplify the key mistakes in financial goal planning by providing clarity on diversification and timelines.

- Budgeting Apps: Mint (free), YNAB ($15/month), or Excel templates

- Investment Platforms: Grip Invest for researching regulated options

- Calculators: Retirement planners and debt payoff simulators

Apps and Tools for Budgeting

Automate savings using apps that sync bank accounts. Tools like Personal Capital help visualize progress toward retirement or debt-free milestones. The 50/15/5 budget framework is easily tracked through these platforms, ensuring goals stay specific and measurable.

Recommended Books and Podcasts

“Writing goals down increases accountability by 42%.” – Harnessing Financial Clarity

Read “Your Money or Your Life” to master mindset shifts. Listen to “The Dave Ramsey Show” for actionable steps on avoiding high-interest debt traps. Online courses like Coursera’s “Personal Finance” cover SMART frameworks and compound interest strategies.

Pair these resources with regular reviews. Use Grip Invest’s research tools to balance risk in portfolios, and refer to books for strategies on maintaining discipline. Avoid key mistakes in financial goal planning by leveraging these tools to stay informed and focused.

Conclusion: Setting Yourself Up for Success

Mastering financial goal setting for 2025 requires avoiding common pitfalls. Steer clear of vague targets and the mistake of neglecting regular reviews. This approach fortifies your financial strategy. Here’s how to translate insights into actionable steps.

Recap of Key Points

SMART goals demand precision. Ambiguous goals like “save more” fall short compared to specific aims like “save $500 monthly for a down payment in 12 months.” Monitor your progress with measurable steps, set achievable timelines, and conduct quarterly reviews. Financial missteps often arise from neglecting deadlines or failing to adapt plans. Align your goals with your core values, such as debt reduction or long-term investments, to maintain motivation.

Encouragement to Start Goal Setting for 2025

Begin today, not tomorrow. Start with a 30-day quick win: increase your emergency fund to three months’ worth of expenses or automate savings. By 60 days, evaluate your debt repayment progress and adjust your spending. At 90 days, reassess your investments or prioritize long-term goals like retirement. Remember, setbacks are opportunities for growth, not failures. Small, consistent efforts lead to significant progress.

Financial confidence grows with immediate action. Utilize apps like Mint or YNAB for budget tracking, or delve into books like “The Total Money Makeover.” Every small step advances you toward 2025 success. Your financial future hinges on starting today. Avoid common errors, embrace clarity, and let SMART goals lead you to financial stability and growth.

FAQ

What are the key components of SMART financial goals?

SMART financial goals are Specific, Measurable, Achievable, Relevant, and Time-bound. These elements ensure your financial objectives are clear and actionable. They help you track your progress and make adjustments as needed.

Why is it important to avoid vague financial goals?

Vague financial goals can hinder progress and cause confusion. Specific goals offer a clear direction and measurable targets. This engages your brain’s goal-pursuit mechanisms and allows for effective tracking of your progress.

How can I make my financial goals measurable?

To make your financial goals measurable, set specific numerical targets. For example, aim to save a certain amount or pay off a specific debt by a certain date. This enables you to monitor your progress and stay accountable.

What should I do if I realize my financial goals are unrealistic?

If your financial goals seem unrealistic, reassess them. Consider your current financial situation, past performance, and expert benchmarks. Adjust your targets to make them challenging yet achievable.

How can I establish effective timelines for my financial goals?

Set time-bound deadlines for each goal, covering short, medium, and long-term timelines. Milestones help maintain motivation and provide clear checkpoints along the way.

Why is it crucial to review and adjust my financial goals regularly?

Regular reviews keep you accountable and allow for adjustments in response to financial changes or external factors. This process boosts your goal achievement rates and keeps you on track.

What are some effective ways to track my financial goals?

Choose from budgeting apps, spreadsheets, or physical journals to track your goals. Select a method that fits your needs and review your progress regularly based on your financial goals.

How can accountability help with my financial goals?

Accountability boosts your chances of achieving financial goals by providing social support and motivation. Regular check-ins with accountability partners or joining financial support groups can increase your commitment to your objectives.

What resources can I use for effective financial goal setting?

Use budgeting apps, financial planning calculators, and resources like books and podcasts focused on financial goal setting. These tools offer guidance and support as you strive to achieve your financial objectives.